extended child tax credit 2021

The Child Tax Credit provides money to support American families. June 14 2021.

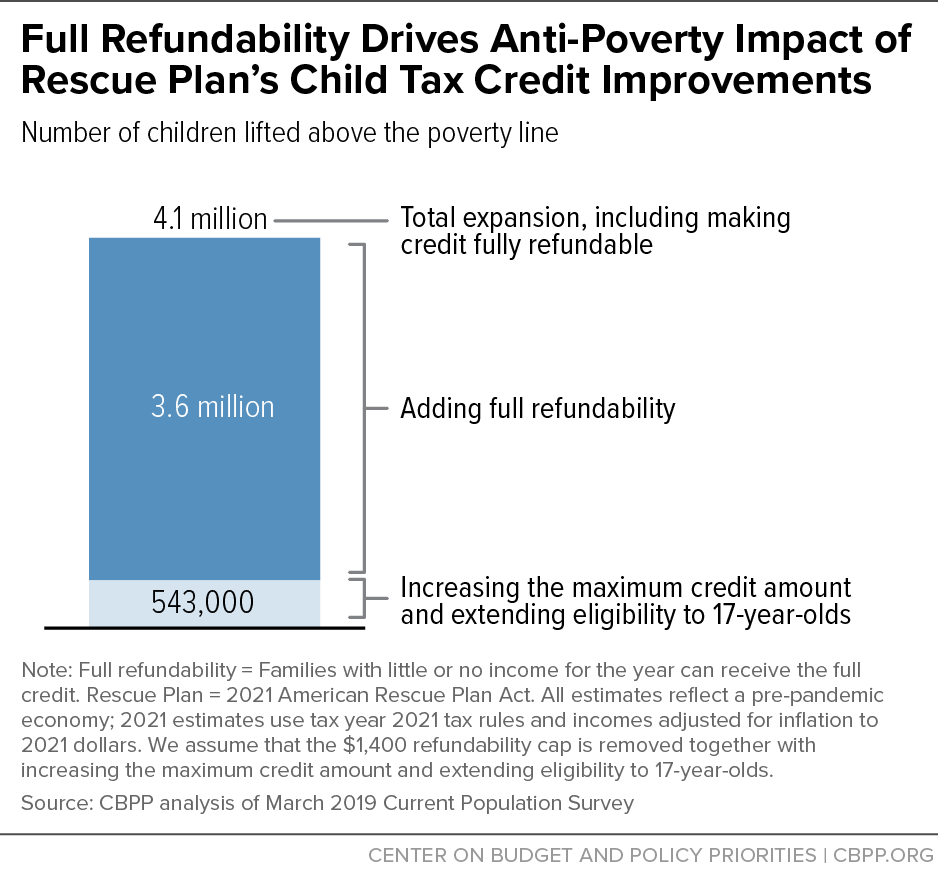

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition.

. The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17. This year the existing child tax credit was expanded to include more children than ever before. Home of the Free Federal Tax Return.

Previously the credit was 2000 per child under 17 and will revert back to that. Families with children will see a significant increase in their maximum child tax credit CTC in 2021 thanks to the American Rescue Plan Act ARPA expanding child-related tax benefits. The American Rescue Plan Act expands the child tax credit for tax year 2021.

Thats an increase from the regular child. IRS Child Tax Credit Money. In 2021 The America Rescue Plan Act ARPA expanded the CTC once again.

The maximum per-qualifying child was expanded by an additional amount of 1600 for children. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. The ARPAs expansion of the child tax credit resulted in a one-year fully refundable credit of up to 3000 per child age 6 and up and 3600 for children under age 6 to.

House-passed version would have extended the 2021 expansion of the child credit for one year 2022 while also making the credit fully refundable permanently beginning in. Originally it offered taxpayers a tax credit of up to. What Is the Expanded Child Tax Credit.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. In a move that could benefit many families House Democrats passed the 175 trillion Build Back Better Act Friday which includes a one-year extension of the enhanced child. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous.

The benefit was increased to 3000 from 2000 for children ages 6 to 17 with an. Included in President Joe Bidens American Rescue Plan the 19tn coronavirus relief package is an extended child tax credit for qualifying families. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021.

Most parents who received monthly payments in 2021 will have more child tax credit money coming this year. Dont Miss an Extra 1800 per Kid. Making the Expanded Child Tax Credit Permanent Would Cost Nearly 16 Trillion.

Here is some important information to understand about this years Child Tax Credit. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. E-File Directly to the IRS.

Learn More At AARP. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The Child Tax Credit Update Portal is no.

Ad See If You Qualify To File For Free With TurboTax Free Edition. For 2021 eligible parents or guardians can receive up to 3600 for each child who. The maximum credit amount has increased to 3000 per qualifying child between.

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act.

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

2021 Child Tax Credit Advanced Payment Option Tas

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Taxes 2022 What Families Should Know About The Child Tax Credit Youtube

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Expanded Child Tax Credit Senator Bernie Sanders

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

Child Tax Credit U S Senator Michael Bennet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Parents Guide To The Child Tax Credit Nextadvisor With Time

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Child Tax Credit Definition Taxedu Tax Foundation

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration